Unlocking Life's Assurance: The Insurance Surgery's Pioneering Path in Covering Every Life

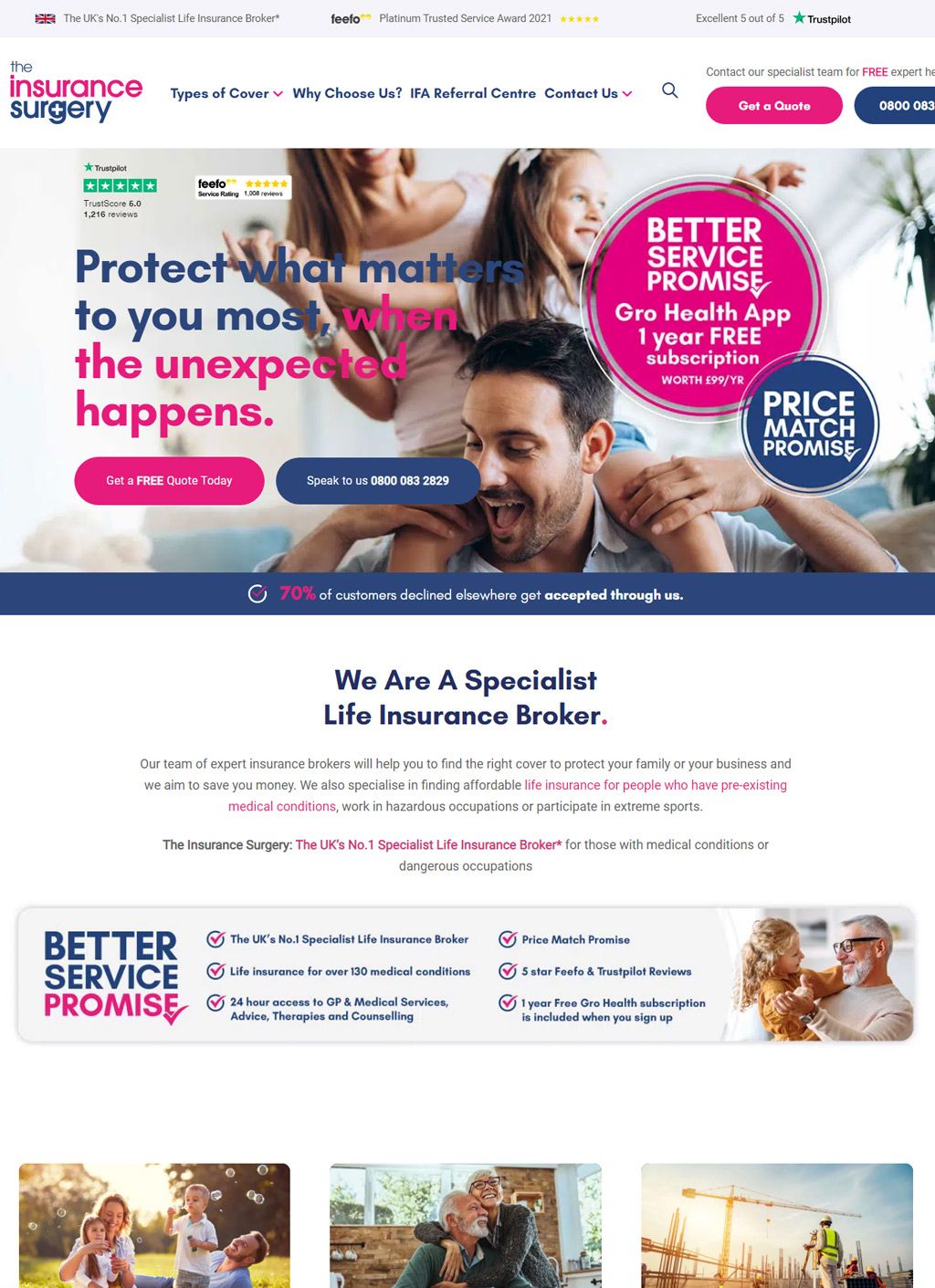

In the vast landscape of insurance, where companies often prioritize the healthy and the risk-free, there stands a beacon of hope for those with health conditions or prior rejections — The Insurance Surgery. In the intricate tapestry of life insurance, they have carved a niche that goes beyond the conventional, ensuring that every individual, irrespective of their health challenges, finds a protective haven. This is the story of The Insurance Surgery, a company that specialises in securing life insurance for those who are often left in the shadows of rejection and uncertainty.

Understanding the Challenge: Navigating the Insurance Maze

Life insurance is traditionally built on the premise of assessing risk. The healthier an individual, the lower the risk, and consequently, the more favorable the insurance terms. However, this leaves a significant portion of the population in a precarious position. Individuals with pre-existing health conditions, whether it be diabetes, heart disease, or a history of cancer, often find themselves facing high premiums or, worse yet, outright rejections when seeking life insurance. This is where The Insurance Surgery emerges as a beacon of hope, offering a lifeline to those who need it most.

The Genesis: A Mission for Inclusion

The Insurance Surgery was not born out of a conventional business mindset; rather, it was conceived from a mission to bridge the gap of insurance accessibility. The founder, driven by personal experiences of witnessing close friends and family members struggle to secure life insurance due to health conditions, saw the need for a service that caters specifically to this demographic. Thus, The Insurance Surgery was born, with a clear vision — to make life insurance inclusive and accessible to everyone.

Breaking Down Barriers: The Insurance Surgery's Unique Approach

At the heart of The Insurance Surgery's success lies its unique approach to underwriting. While traditional insurers rely heavily on standard risk assessments and actuarial tables, The Insurance Surgery employs a more personalized and empathetic model. The company recognizes that each individual is unique, and health conditions should not be treated as one-size-fits-all risks. This personalized approach involves a thorough understanding of the client's medical history, lifestyle, and future aspirations.

1. Expertise in Specialised Underwriting

The Insurance Surgery has assembled a team of experts well-versed in specialised underwriting. These professionals understand the intricacies of various health conditions and can navigate the complex world of insurance underwriting with finesse. Their expertise allows them to present a compelling case to insurers, showcasing the client's health condition in a nuanced light, emphasizing factors that may mitigate risks.

2. Access to a Vast Network of Insurers

One of The Insurance Surgery's key strengths is its extensive network of insurers. Unlike traditional brokers who may have limited partnerships, The Insurance Surgery has cultivated relationships with a diverse range of insurance providers. This extensive network enhances the chances of finding a willing insurer for even the most challenging cases, ensuring that no client is left without coverage.

3. Cutting-Edge Technology: Streamlining the Process

In the digital age, efficiency is paramount. The Insurance Surgery understands this and has invested in cutting-edge technology to streamline the application process. From the initial inquiry to the final policy issuance, the use of technology ensures a swift and hassle-free experience for clients. This commitment to efficiency is particularly crucial for individuals with health conditions who may already be grappling with various challenges.

Navigating Health Conditions: The Insurance Surgery's Specialised Services

The crux of The Insurance Surgery's success lies in its ability to navigate the intricacies of health conditions. The company has developed specialised services tailored to address the unique needs of individuals with various medical histories.

1. Diabetes Insurance Solutions

Diabetes, a prevalent health condition, often poses challenges in securing life insurance. The Insurance Surgery, however, has a dedicated team that specialises in securing favorable insurance terms for individuals with diabetes. This includes type 1 and type 2 diabetes, ensuring that clients receive the coverage they need without exorbitant premiums.

2. Heart Conditions: From Rejections to Acceptance

Heart conditions are another area where traditional insurers often hesitate. The Insurance Surgery's experts understand the nuances of different heart conditions, from hypertension to more complex cardiac issues. By presenting a comprehensive and accurate picture of the client's health, they work towards transforming rejections into acceptances.

3. Cancer Survivors: A Second Chance at Coverage

For individuals with a history of cancer, securing life insurance can be a daunting task. The Insurance Surgery recognizes the triumph of survival and provides a second chance at coverage. Their experts understand the complexities of post-cancer life and craft compelling cases that resonate with insurers, ensuring that survivors can protect their loved ones.

The Human Touch: Empathy in Every Interaction

In an industry often criticized for its lack of empathy, The Insurance Surgery stands out for its human-centric approach. The team understands that behind every health condition is a unique individual with dreams, aspirations, and a desire to protect their loved ones. This understanding forms the foundation of every interaction, from the initial consultation to the finalization of the policy.

1. Personalised Consultations: Beyond the Numbers

The Insurance Surgery doesn't just see clients as data points on a medical history sheet. Personalized consultations form an integral part of their process, allowing clients to share their stories, concerns, and goals. This personalized approach goes beyond the numbers, creating a human connection that is often lacking in the insurance industry.

2. Advocacy in Action: Navigating the Bureaucracy

Securing life insurance with a health condition often involves navigating bureaucratic hurdles. The Insurance Surgery takes on the role of an advocate, ensuring that clients' voices are heard. Whether it's communicating with underwriters, liaising with medical professionals, or challenging unfair rejections, the team goes above and beyond to champion the cause of their clients.

3. Education and Empowerment: Informed Decision-Making

Understanding life insurance can be overwhelming, especially for those dealing with health conditions. The Insurance Surgery places a strong emphasis on education, ensuring that clients are empowered to make informed decisions. By demystifying the jargon and explaining the intricacies of policies, they enable clients to navigate the process with confidence.

Success Stories: Transforming Lives One Policy at a Time

The true measure of The Insurance Surgery's impact lies in the stories of transformation — individuals who, against the odds, secured life insurance and gained the peace of mind they deserved.

1. Sarah's Triumph Over Diabetes

Sarah, a young professional with type 1 diabetes, faced numerous rejections when seeking life insurance. The Insurance Surgery's diabetes insurance specialists took on her case, presenting a comprehensive picture of her health and lifestyle. The result? Sarah not only secured coverage but did so with premiums that reflected her actual risk, not a generic assumption.

2. John's Journey Post-Heart Surgery

After undergoing heart surgery, John was met with skepticism from insurers. Traditional brokers were hesitant to take on his case. The Insurance Surgery, however, saw beyond the surgery and understood the steps John had taken to prioritize his health post-surgery. They presented a compelling case, and today, John enjoys the security of life insurance tailored to his unique situation.

3. Emma's Survivorship Beyond Cancer

Emma's battle with cancer left her feeling vulnerable, especially when it came to securing life insurance. The Insurance Surgery's team of experts recognized the resilience of Emma's journey and worked tirelessly to find her a policy that acknowledged her situation. Their dedication and expertise transformed Emma's vulnerability into a story of empowerment and security.

Business address

Insurance Surgery

2nd floor, Pickford Mill, Pickford Street,

Macclesfield,

Cheshire

SK11 6JD

United Kingdom

Contact details

Phone: 08000832829